Strategowie finansowi – Pomoc ludziom w finansach – AUM – Aktywa w zarządzaniu

العربية English Français polski

tel. +48 666 048 421

contact@negoce.org

Skype: czeslawrolla Negoce.org > Oferty > Finansowe Instytucje > Strategowie finansowi – Pomoc ludziom w finansach – AUM – Aktywa w zarządzaniu

Strategowie finansowi – Pomoc ludziom w finansach – AUM – Aktywa w zarządzaniu

Warunki

Gwarancja

6 miesięcy

W cenie oferty

Koszty uruchomienia

Dostawa

Do 1 miesiąca

Strategowie finansowi – Pomoc ludziom w finansach – AUM – Aktywa w zarządzaniu

Strategowie finansowi

Strategowie finansowi – Pomoc ludziom w finansach – AUM – Aktywa w zarządzaniu

Misja

W firmie Finance Strategists uważamy, że jednym z najlepszych sposobów, w jaki możesz komuś pomóc, są jego finanse.

Tworzymy pomocne filmy informacyjne i treści, aby pomóc ludziom przejąć kontrolę nad swoimi finansami.

Wierzymy, że wychowanie pokolenia liderów posiadających wolność finansową może zmienić życie jednostek, dzielnice, kraje i świat.

Finance Strategists – Helping People With Their Finances – AUM – Assets Under Management

Finance Strategists

Finance Strategists – Helping People With Their Finances – AUM – Assets Under Management

Mission

Here at Finance Strategists, we believe one of the best ways you can help someone is with their finances. We create helpful informational videos and content to help people take control of their finances.

We believe raising up a generation of leaders with financial freedom can change individual lives, neighborhoods, countries, and the world.

Twitter Instagram Youtube Linkedin

Finance Dictionary

View our list of the most helpful finance terms below.

– Valuation Methods– AUM

– Types of Assets – Bonds

– Annual Percentage Rate– Bull Market

Facebook Twitter Instagram Youtube Linkedin

Read More

AUM (Assets Under Management) Definition

True Tamplin, BSc

What Does AUM Stand For?

Share on facebook

Share on twitter

Share on linkedin

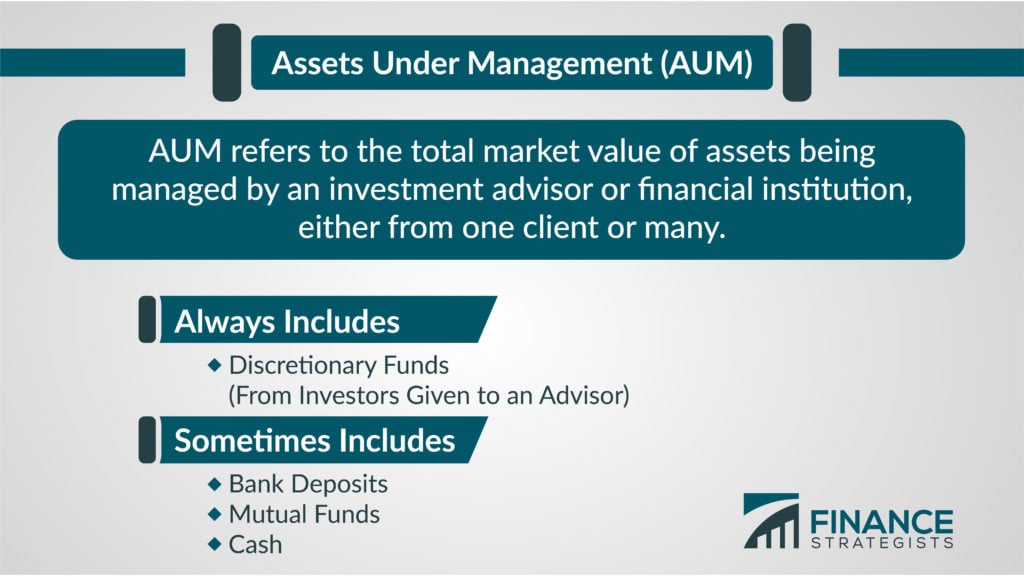

The AUM acronym stands for “Assets Under Management.”

It refers to the total market value of assets being managed by an investment advisor or financial institution, either from one client or many.

To define AUM precisely, the exact definition of AUM varies by institution; some include bank deposits, mutual funds, and cash in their computation, while others only consider the discretionary funds that investors have given an advisor to trade on their behalf.

AUM fluctuates as the value of the assets managed changes with market performance.

What Is AUM in Finance?

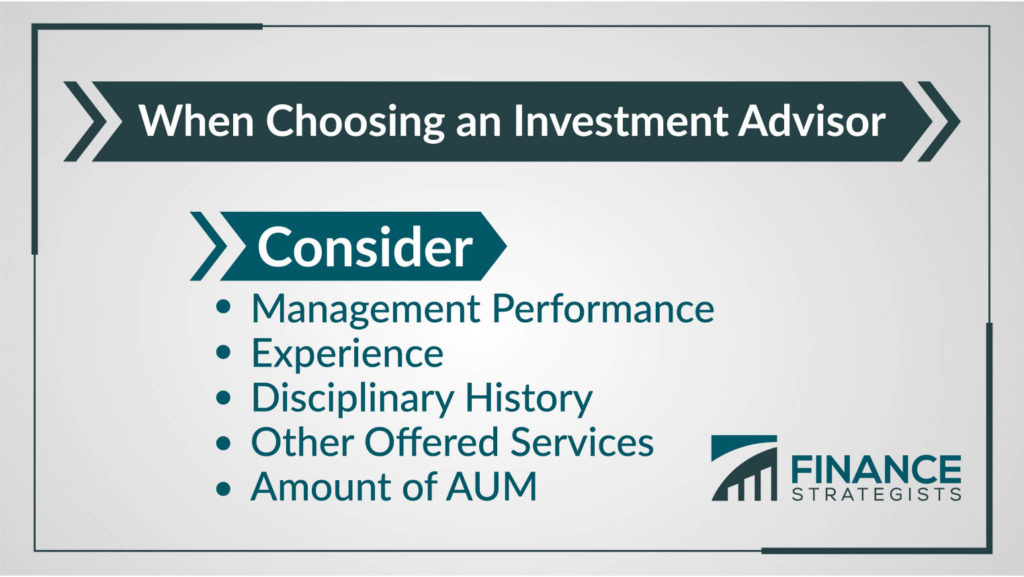

When evaluating a portfolio manager, assets under management (AUM) is one metric investors consider.

Among other variables such as management performance, experience, disciplinary history, and other offered services, a greater AUM can be an indicator of a manager who has demonstrated proficiency.

Investment advisors that oversee more than $25 million in AUM must register with the Securities and Exchange Commission (SEC).

Advisors overseeing less may register with state securities administrators.

AUM Payment and Fees

Managers may charge a percentage of the total AUM they manage for a client for their services, such as 1%.

Screenshot from our animation video showing an example of a 1% advisor fee.